今年5月3日,小米正式向港交所递交了上市申请,有望成为香港首支“同股不同权”公司。有媒体称小米集团IPO有可能将是2014年以来全球最大IPO。今天,小米将确定IPO发行价,7月9日挂牌上市。

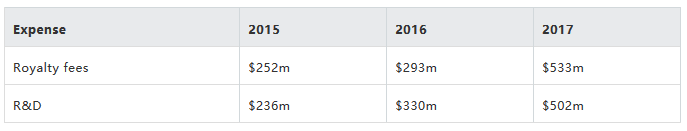

据IAM报道,根据IPO文件显示,过去三年来,小米公司支付的知识产权许可费已超过10亿美元,这还没算爱立信的许可费,因为小米和爱立信就此问题在印度还在诉讼中。2017年,小米公司支付的知识产权许可费占到了其营收的4%,该年度,小米公司的知识产权许可费为5.33亿美元,而该年度的研发费用为5.02亿美元,知识产权许可费比研发费用还要高。

Xiaomi has spent over $1 billion on IP royalties over the past three years, IPO documents show

By Jacob Schindler | IAM

File this under: things I missed while going through Xiaomi’s 600-page IPO prospectus. An analysis at Chinese tech news portal Sina points out that the company revealed its IP licensing outlays for the past three years (hat tip to Don Merino for digging this up and sharing on LinkedIn).

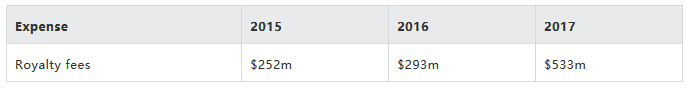

Here are the figures, converted to present US dollars (the original data can be found on page 447 of this document):

To be specific about what's being reported, Xiaomi describes these figures as "royalty fees paid to third-party intellectual property holders". On the balance sheet, they are recorded as a component of the company's cost of sales in the smartphone segment.

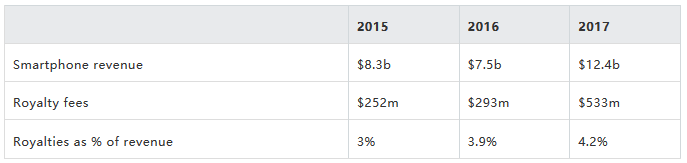

The increasing figures are no surprise given the new licence agreements Xiaomi has entered into over the years. In 2016, it signed deals with Qualcomm (for mainland China), Microsoft and Via Licensing. In late 2017, Xiaomi agreed to a global Qualcomm licence as well as a new deal with Nokia. That half-billion dollar plus figure for 2017 may include a one-off catch-up payment to Nokia.

We can compare these royalty figures to Xiaomi’s smartphone revenues, which it breaks out in its IPO prospectus. Due to the above-mentioned catch-up payments we can’t be sure how well these figures match up to actual running rates, but they give a rough picture of the Chinese company’s aggregate royalty burden.

Of course, one major licensor with which Xiaomi does not have an agreement in place is Ericsson. The two sides are litigating in India, where the Delhi High Court has ordered Xiaomi to deposit interim royalties (originally 100 rupees per device sold in India) for the duration of the case. It’s not clear whether those payments have been accounted as royalties in these figures; in any case, an eventual global licence deal with Ericsson could be expected to add measurably to Xiaomi’s royalty burden.

Another interesting point of comparison is Xiaomi’s royalty spend versus its R&D spend. Licensing fees were the bigger expense in two out of the three reported years:

In case you missed it, you can find much more IAM analysis of Xiaomi’s IPO filing – which discloses the company’s portfolio size, application spend and cost of third party patent acquisitions – at this link.

Source:http://www.iam-media.com/blog/detail.aspx?g=D1473602-2C70-4FD7-808E-0901A1C240FA

来源:IPRdaily综合大岭IP、IAM、腾讯科技

编辑:IPRdaily赵珍 校对:IPRdaily纵横君

上一篇: 苹果iPhone、iPad被诉侵犯专利涉及输入法和3D Touch